You must pay for the return postage and any taxes and duties applied.

Contact us within 30 days of receipt of the item to let us know of your intention to return the item/s.

We strongly recommend that you return the item/s via DHL Express Worldwide as we are not responsible for items that do not reach us. Import tax/duty may also be applied by UK customs if the item/s are not shipped correctly.

Return the item/s to us within the original packaging (including padded envelope). Attach the DHL return label supplied with your order to the outside of the parcel. If you are only returning part of your order, we will need to send you a new DHL return label.

Drop off the parcel at your nearest DHL Service Point, and hand the shipper the Antique Declaration that was attached to the outside of the original DHL envelope. Please request a copy from us if this has been misplaced.

Please be aware that taxes and duties are NOT refunded for shipments to Australia.

Free Australia Shipping

Free Australia Shipping View All

View All

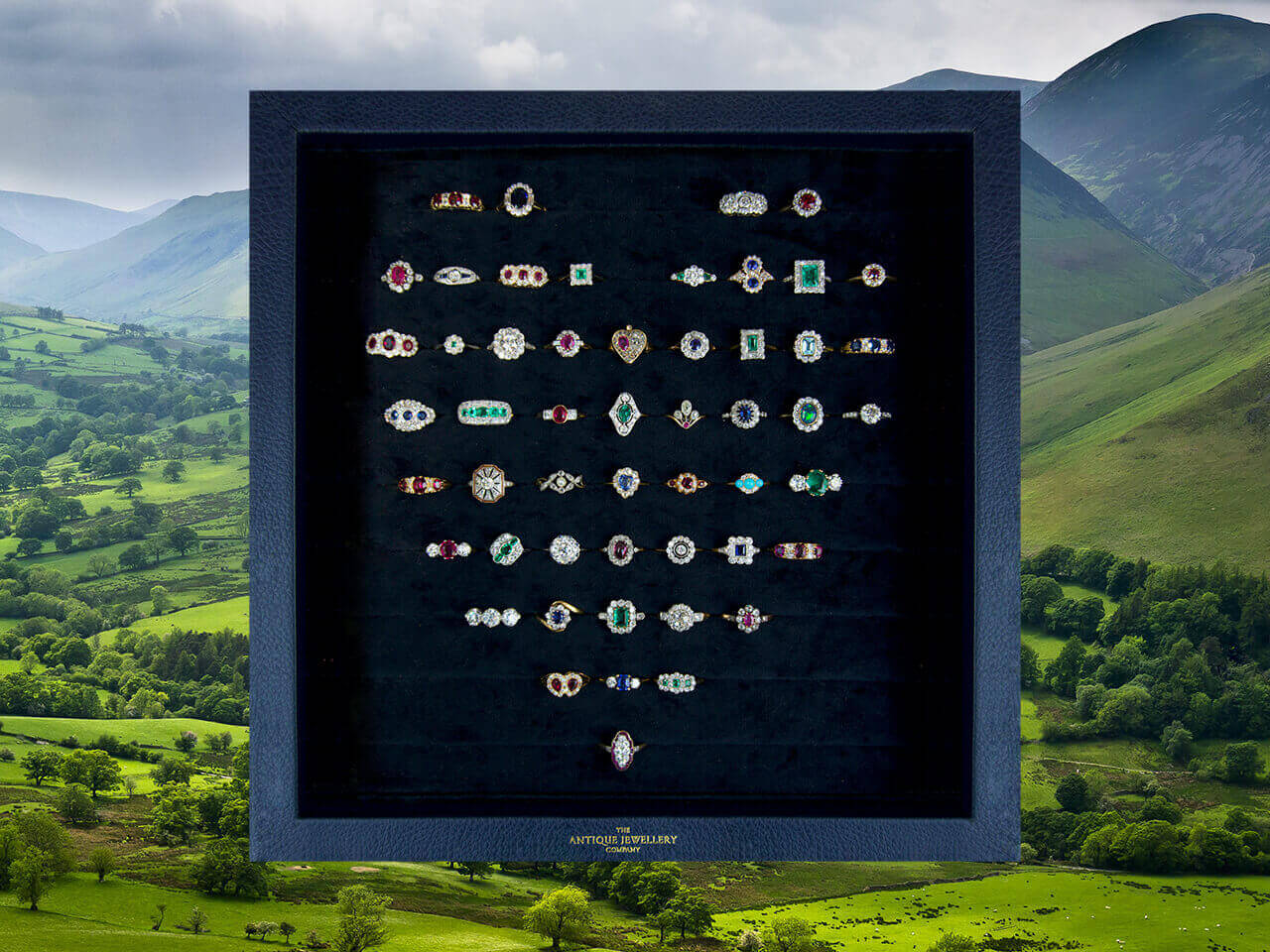

Diamond Rings

Diamond Rings

Sapphire Rings

Sapphire Rings

Emerald Rings

Emerald Rings

Ruby Rings

Ruby Rings